What is it about family dysfunction?

The large majority of my job is facilitating, educating and coaching families who share ownership of businesses and legacy wealth to help them communicate well, manage conflict, create high-functioning, family-ownership teams and develop governance for decision making, sharing information and inclusion of subsequent generations. I also specialize in working with couples–pre-children or with very young children on how to set the stage for responsible, productive and values-based lives in the context of family financial success. My most fulfilling work by far is work like this–where families reach out to me proactively before conflict is heavy.

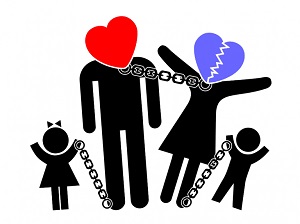

Still, over the years, people who have been given the above description of my expertise, even close friends and colleagues I’ve known for decades, have tended to focus solely on the family dysfunction piece. They ask–with very piqued interest–what kinds of crazy families and drama I am encountering. Yet no matter how carefully I lay out the ways I can be helpful proactively (before it “hits the fan”) to business families, families with legacy wealth and parents looking to lay early and solid foundations for future stewardship, the image of “fighting families” is what sticks.

This interests me.

I suspect one key reason for this persistent intrigue with dysfunction is the reality that every family has struggles, challenges, and conflict–even without sharing ownership of a business or wealth of some kind. Family and conflict go together, so every family knows some level of dysfunction.

And if family interactions are complex on their own, they certainly become more complex when they involve sharing ownership and leadership of significant assets. Even so, I find myself disappointed that all the positive and fulfilling aspects of healthy family interactions are so much less riveting than conflict.

Movies and TV series do not help set better examples. Family members at each other’s throats make for entertaining drama. And the viewing public loves it! This likely further enforces perceptions of mostly turmoil in family life.

I generally make less in fees when the complexity of sharing ownership is addressed early on, as less time and effort is needed to keep the family and business healthy. But I’ll take this work over the higher-paying, conflict-based engagements every time; it is incredibly fulfilling. And though the large majority of my clients still wait until they’re in great pain before reaching out, the good news is the number of families getting ahead of the curve and proactively seeking help is growing!

Recent examples from my practice of successfully addressing problems early on include these cases:

- Blue-collar, high-school sweethearts made it big with a risky investment and hard work. Now parents of a newborn and a 2- and 3-year-old and a net-worth of $150MM, they work with me to learn parenting techniques for the first few years of life and beyond. I run them through a Certified Money Coaching assessment and help them understand similarities and significant differences around how they view money and its purpose and help them to find common ground and support one another with money struggles. I coach them on how to manage friendships which are becoming more complicated, as emotionally unhealthy friends become preoccupied with envy and competitiveness.

- A father wants to hand over his business to his son who has experience in and out of the family company and an MBA. Father, son and executive team all know son needs more development around leadership but find it tricky to provide it, as father and son fear the stresses could negatively impact their relationship. I am brought on board to work with them individually and jointly. Together, we work to develop the son’s leadership skills over time, while protecting the father-son relationship they both value.

- An ultra-high-net-worth family with an international reputation and high visibility has handled things on their own regarding generational transitions of wealth. They have been reading and hearing about opportunities to have family meetings and to include young children and teens. I am contacted by their professional team and brought in to educate the senior generation about the opportunities and address their concerns about including young kids and teens. I share with them developmentally appropriate ways to tell the family story (the ups and downs, the money-specific, and the many other realms of family experience). I also work with the senior generation to explore my philosophy: “You can talk about family financial success without mentioning money and, when ready, you can talk about money without using numbers.”

Family conflict is normal within all families and the complexity of shared ownership has real pressures–which create the potential for intense conflict if the complexity is not proactively managed. While “fighting families” make for great entertainment, many families prefer and seek the calmer and more satisfying alternative of proactively developing healthy communication and family-specific governance. Personally, I’ll trade the higher fees of messy conflict for the deeply rewarding early, positive, growth and development work. My clients who chose this proactive route would certainly agree it was worth the upfront effort to avoid dysfunction—fascinating as it may be!